You know that sinking feeling, don’t you? The moment when the storm’s intensity ramps up and you’re left wondering what havoc it will wreak on your home. It’s a terrifying thought, but there’s some comfort in knowing that you’ve got insurance to cover potential damages.

But hold on! Navigating the labyrinth of an insurance claim post-storm isn’t a walk in the park. That’s where we come in – we’re here to guide you through this often-confusing process with four essential tips every homeowner should be aware of.

When disaster strikes, it’s natural to feel overwhelmed. Your mind races with questions: How bad is the damage? Will insurance cover it all? How long will repairs take? While these concerns are valid, remember – knowledge is power. By understanding your policy beforehand, documenting everything meticulously, contacting your insurer promptly and hiring a professional for damage assessment, not only can you expedite your claim process but also ensure maximum coverage under your policy.

We’re here to help navigate those choppy waters because we believe that no one should face such trials alone.

Understanding Your Policy Beforehand

You’ve got to truly understand your policy before disaster strikes, so you’re not left in the dark when it’s time to file a claim. It’s like having that trusty flashlight during a blackout; with it, you can navigate through even the most challenging terrains. Your insurance policy is no different.

Think about it: would you rather stumble around in confusion after suffering storm damage or confidently know exactly what steps to take for reparation? Yeah, we thought so! Get familiar with all those puzzling terms and conditions now; they might just become your lifeline later.

We get it, insurance documents can seem as daunting as climbing a mountain without any gear. But here’s the thing – once you start making sense of them, everything becomes simpler. You’ll know what your coverage limits are and where gaps lie that could potentially leave your home vulnerable. And guess what? If something seems unclear or doesn’t sit right with you – speak up! Your insurer is there to help clarify these complexities and guide you towards solutions that suit your needs best.

Remember, knowing your policy inside out won’t just empower you during crisis moments but also foster peace of mind on sunny days too!

Documenting the Aftermath Thoroughly

In the quiet aftermath, it’s vital to meticulously capture the extent of your property’s distress through photos and detailed notes. This isn’t just a mundane task, but your lifeline to ensuring you get a fair shake from your insurance company.

So grab that camera or smartphone and start clicking away at every inch of damage—inside out—and make no assumptions about what is important or not. Each photograph serves as irrefutable evidence when you’re negotiating your claim.

Likewise, don’t forget to jot down observations in real-time; this can be an emotional time, we know, but those little details may slip from memory quicker than you think.

Remember that documentation isn’t something that’s done once and forgotten about—it’s an ongoing process throughout the recovery period. Make sure to update your records if new damages emerge over time due to initial storm impact or during repair works—you never know what might prove crucial in establishing your claim’s validity.

Moreover, keep all invoices, receipts related to repairs or replacements—the more paperwork supporting your claim, the better! It’s a meticulous process for sure but remember it’s not just about getting back on track; it’s also about claiming what’s rightfully yours without leaving anything on the table.

Contacting Your Insurer Promptly

Don’t dilly-dally when it comes to reaching out to your insurer; time’s of the essence! Insurance companies operate on a first-come, first-serve basis. The sooner you get in touch with them after the storm, the quicker they can start processing your claim.

Reporting the damage promptly might also be necessary to meet your policy’s requirements for coverage. So grab that phone and dial their number like there’s no tomorrow.

Remember, a friendly chat with your insurer isn’t just about kick-starting the claims process. It’s also an opportunity for you to discuss your coverages, deductibles, and what exactly will happen next. It’s okay if you’re feeling overwhelmed or confused – that’s what they’re there for!

They’ll walk you through everything step by step and help put your mind at ease during this tough time. After all, isn’t it comforting knowing someone’s got your back?

Hiring a Professional to Assess the Damage

Once the dust has settled, it’s time to bring in a seasoned pro who can give your property the once-over and accurately assess any harm inflicted by Mother Nature’s wrath.

You might think you have an eagle eye for damage, but trust me, nothing beats the keen observation skills of a trained professional. These experts know exactly what to look for and where to look. They’ve seen it all and they’ll ensure no stone is left unturned – literally!

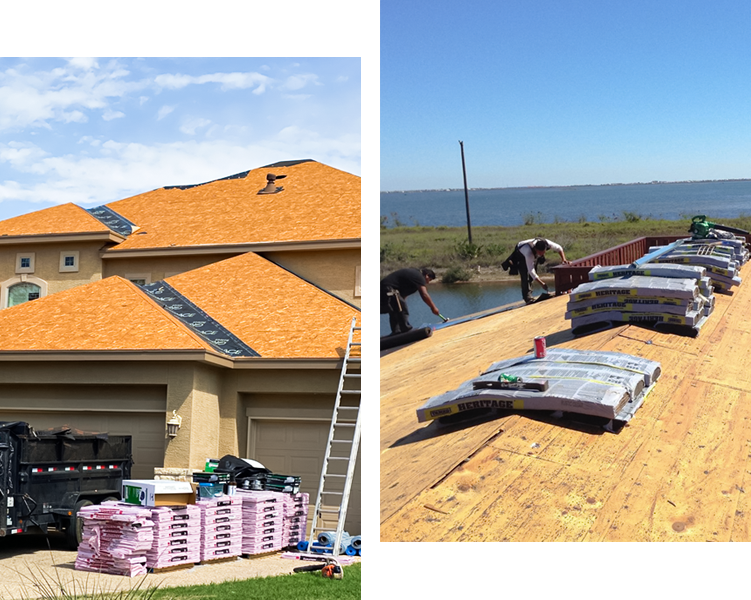

From waterlogged basements to wind-beaten roofs, they’ll identify every bit of damage that could be hiding in plain sight.

Now let me tell you – hiring professionals isn’t just about spotting apparent damages; it’s also about uncovering potential problems that may not be visible right off the bat. This could include structural issues or hidden leaks that if left unattended could lead to more extensive damages down the line.

The detailed report these pros provide will not only help you understand what repairs are necessary but also provide solid evidence when filing your insurance claim. So don’t cut corners here – get yourself a pro who’ll have your back through this stormy ordeal!

Keeping Track of All Related Expenses

You’ll want to keep a close eye on your wallet too, because jotting down all those disaster-related expenses can really save your bacon in the long run.

When you’re up to your elbows in soot or water damage, it’s easy to lose track of just how much you’re shelling out.

Between temporary housing costs, meals eaten out because your kitchen is a mess, and even the cost of gas for extra trips between home and hardware stores – these all add up quickly.

And let’s not forget about the cost of professional services you may need like contractors, plumbers or electricians.

The good news is that many of these costs are recoverable if you’ve got comprehensive homeowner’s insurance coverage.

But here’s the catch – unless you have receipts and documentation for everything, getting reimbursed can be a real bear.

So get into the habit of keeping every receipt related to storm damage repairs.

Maintain a detailed logbook with dates, descriptions and amounts spent.

This might seem like an unnecessary hassle when dealing with an already stressful situation but trust me; this little bit of diligence will pay off big time when it comes to settling your claim!

Negotiating with the Insurer

Navigating the choppy waters of negotiation with your insurer can be tricky, but it’s a crucial step in getting back on your feet. You might feel like you’re in over your head, but remember, you’ve got this!

The first thing to keep in mind is that the initial offer from an insurance company is usually just that – an initial offer. It’s not set in stone, and it’s certainly not the final word on what they’re willing to pay out for your storm damage claim. Don’t hesitate to push back if you feel their estimate falls short.

Negotiating doesn’t mean being confrontational or argumentative; instead, it means standing up for what’s rightfully yours and making sure you get a fair deal. Bring all your documentation to the table – photos of damage, estimates from contractors or repairmen, lists of damaged items and their value – these are all powerful tools in negotiating with insurers.

If things get tough or confusing, consider hiring a public adjuster or an attorney who specializes in insurance claims to help guide you through this process. Remember, at the end of the day, your home is more than just property – it’s where your heart resides.

Appealing a Denied Claim

It’s disheartening when your claim gets denied, but don’t throw in the towel just yet – there’s still a chance to turn things around.

We get it; being told that you won’t receive compensation for storm damage to your home feels like a punch to the gut. But remember, every problem has a solution. You’ve got rights as an insurance policyholder, and one of those is the ability to appeal an unfavorable decision made by your insurer.

It may seem daunting at first, but you’re stronger than any storm.

Take a deep breath. Now, let’s dive right into how you can appeal effectively.

Start with reviewing why your claim was denied; it could be due to missing documents or misunderstandings about your policy coverage – easily rectifiable issues if handled correctly!

Write a firm yet respectful letter outlining why you believe their decision is wrong and include all supporting documentation – photos of the damage, repair estimates and so forth.

Be sure to keep copies of all correspondences too!

Remember: this is a marathon, not a sprint; patience and persistence will be key here. After all, it’s not just about getting what you’re owed – it’s about standing up for yourself too.